Best Render Farm for 2026

3D Rendering Market Insights from 2025: Predicting the Best Render Farm for 2026.

As 2025 draws to a close, it’s time to look back at the global 3D rendering market’s development over the past year. This year has seen significant technological advancements, strong growth across diverse industries, and the sustained growth of rendering farms as indispensable tools for creating complex, high-quality visual content. In this article, we’ll review the key trends and leading players that defined the 3D rendering industry in 2025 and highlight the best render farm for 2026.

The growth potential of the global 3D rendering market

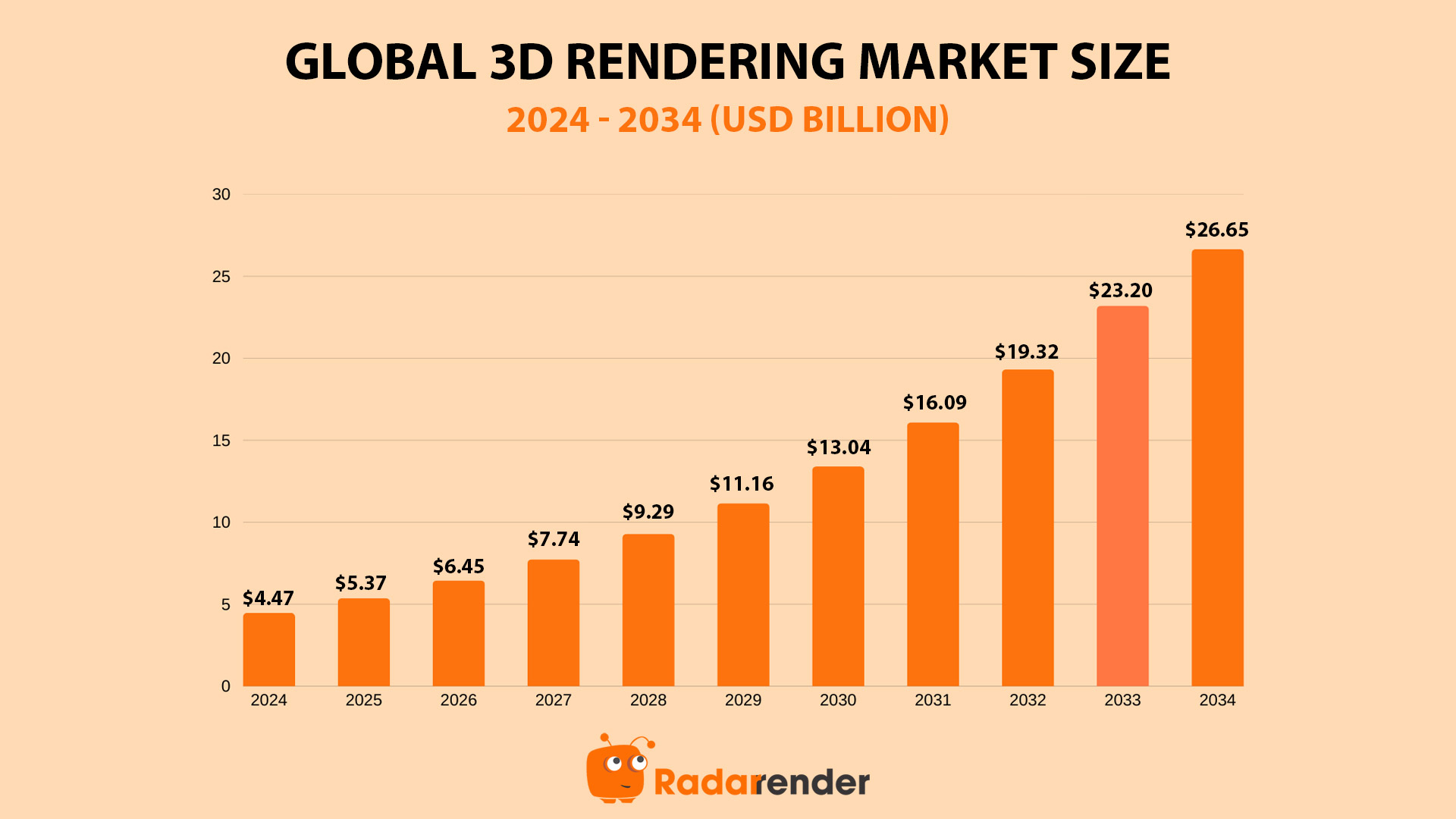

The global 3D rendering market was valued at around USD 5.37 billion in 2025 and is expected to grow rapidly, reaching approximately USD 6.45 billion in 2026 and soaring to nearly USD 26.65 billion by 2034. This impressive expansion reflects a strong compound annual growth rate (CAGR) of about 19.55% between 2025 and 2034. The market’s growth is largely driven by the increasing demand for real-time rendering and advanced simulation technologies across multiple industries, where high-quality, interactive visualizations are becoming essential.

Data source: precedenceresearch.com

Data source: precedenceresearch.com

Why has this development occurred? Let’s review the main factors as follows:

- Innovations and technological development

Innovations such as advanced GPUs, real-time rendering capabilities, and sophisticated rendering software have revolutionized the 3D rendering process. These technologies enable faster rendering, higher realism, and greater accessibility for users across industries.

- High demand for visual content

The demand for high-quality, vivid, and realistic 3D visuals has increased significantly as audiences expect more immersive and visually compelling content. Industries such as gaming, film, and advertising increasingly rely on advanced 3D imagery to capture attention and deliver engaging experiences more effectively than traditional visual methods.

- Widely used in various industries

Alongside the growing demand for visual quality, 3D rendering is being widely adopted across diverse industries, including entertainment, architecture, automotive, real estate, tourism, and virtual experiences.

The rapid growth of e-commerce and online retail is boosting demand for 3D rendering software, as interactive and high-quality product visualizations help improve customer experience and increase online conversion rates.

Also, the increasing adoption of 3D rendering in education and professional training is driving market growth by enabling immersive learning and realistic simulations in fields such as engineering, healthcare, aviation, and design.

- Growing Interest in Virtual and Augmented Reality

In particular, the increasing interest in virtual reality (VR) and augmented reality (AR) applications is significantly impacting the 3D rendering software market. The gaming industry is witnessing a boom in VR content, while sectors such as real estate and tourism are also adopting AR to enhance customer interaction.

3D Rendering Market Segments

Application Insights

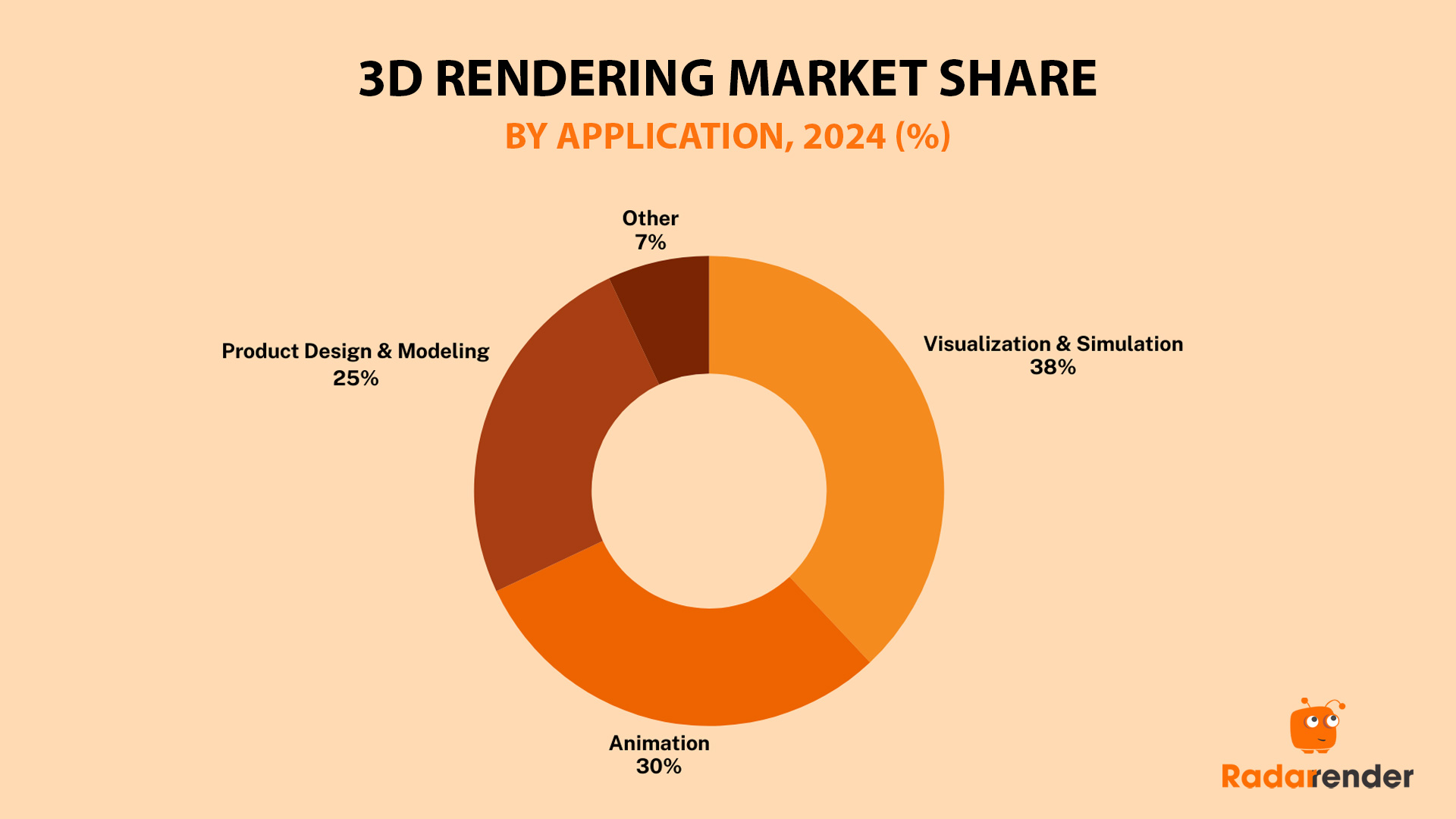

Data source: precedenceresearch.com

Visualization & Simulation remain the dominant application in the 3D rendering software market (38%), primarily due to their integration into development projects, marketing, and client presentations. Its demand stems from the need for detailed visualization and the ability to communicate ideas effectively to stakeholders.

Animation is the second-largest application with a 30% market share, highlighting the essential role of 3D rendering in the entertainment and media industry. Product design and modeling contributed 25%, indicating its frequent use in product development workflows.

Others include other specialized or emerging applications beyond the three main areas, demonstrating the flexibility and scalability of 3D rendering technology across diverse industries.

Region Insights

The regional segmentation of the 3D rendering market directly influences render farm selection through infrastructure, server location, performance, pricing, and support quality. The top render farms for 2026 will be those with global reach, optimized for each region, and flexible enough to meet the diverse needs of users worldwide.

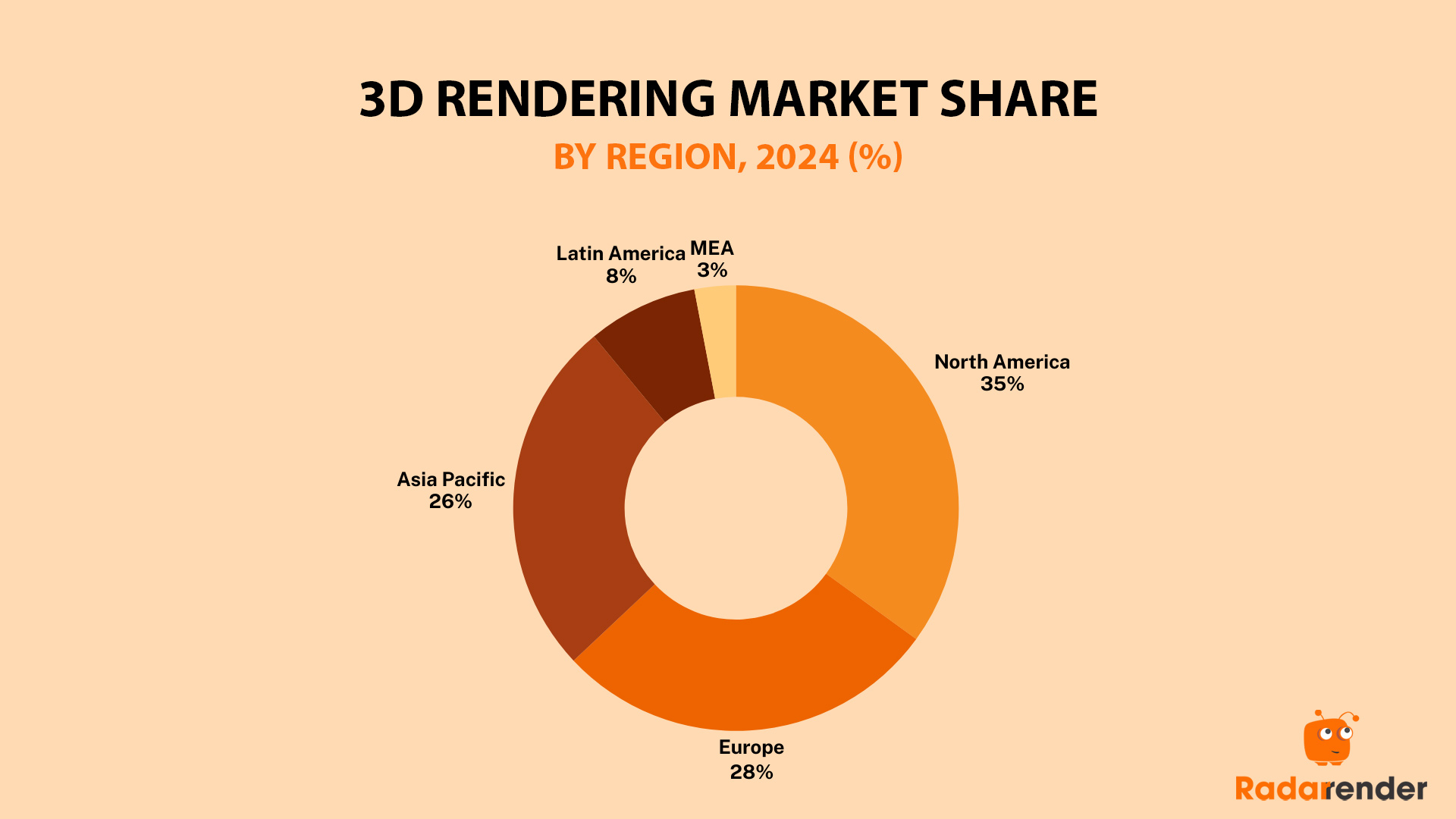

Data source: precedenceresearch.com

Data source: precedenceresearch.com

North America dominated the 3D rendering market in 2024 with 35% due to the increasing use of rendering applications in sectors such as construction, manufacturing, healthcare, education, and real estate in the North American region. The region is expected to experience strong growth in 3D rendering and visualization software thanks to reliable wireless connectivity. The rapid adoption of the latest technological trends across many fields has positively impacted the growth of the 3D rendering market in North America.

Europe follows closely with 28%, supported by steady growth in architectural visualization, automotive design, and industrial simulation. Meanwhile, the Asia-Pacific region accounts for 26%, representing the fastest-growing market due to rapid digitalization, expanding construction activity, and rising adoption of 3D content in gaming and e-commerce.

In contrast, Latin America (8%) and the Middle East & Africa (3%) hold smaller shares but show long-term growth potential as infrastructure development, real estate projects, and digital transformation initiatives increase across these regions.

Component Insights

An analysis of the 3D rendering market share by component reveals two dominant forces shaping the future of the industry: software innovation and cloud-based infrastructure.

The software segment has held the largest market share, driven by continuous improvements in usability, scalability, and advanced features. As 3D software evolves rapidly, render farms must keep pace by supporting the latest versions of major tools like 3ds Max, Maya, Blender, Cinema 4D, and Houdini, along with their associated render engines and plugins.

At the same time, the cloud component is the fastest-growing segment of the 3D rendering market. Accelerated digital transformation and widespread adoption of cloud services are pushing studios and freelancers toward cloud-based render farms that offer on-demand scalability, remote access, and cost-efficient rendering without the need for local infrastructure.

End-use Insights

Architects account for the largest share of the 3D rendering software market, as they consistently rely on advanced visualization tools to enhance building designs and client presentations. Realistic 3D renders are essential during the planning and design stages to communicate ideas clearly and effectively.

Game developers represent the fastest-growing segment, driven by the rapid expansion of the gaming industry and increasing demand for immersive, high-quality graphics.

At the same time, the automotive sector is experiencing strong growth as manufacturers increasingly adopt 3D modeling and simulation to streamline vehicle design and development processes.

Key Players in the 3D Rendering Market

Several industry leaders dominate the 3D rendering landscape, driving innovation and offering robust solutions tailored to diverse needs:

- Adobe: Known for Adobe Dimension and Substance 3D.

- Autodesk Inc.: Makers of 3ds Max, Maya, and Arnold.

- Chaos Software: Developers of V-Ray and Corona.

- Dassault Systèmes: Creators of SOLIDWORKS Visualize.

- Epic Games, Inc.: Pioneers of Unreal Engine and Twinmotion.

- Lumion: Renowned for user-friendly architectural rendering tools.

- Maxon: Known for Cinema 4D and Redshift.

- NVIDIA: Innovators of Omniverse and NVIDIA Iray.

- SideFX: Creators of Houdini for advanced VFX.

- Unity Technologies: Developers of Unity for real-time rendering.

Render Farm: The Backbone of High-Quality Rendering

As the demand for realistic content increases, render farms become incredibly important to meet the industry’s needs. These cloud-based solutions provide the computing power needed to render complex projects efficiently.

Advantages of Render Farms:

- Advanced Technology: Access to the latest GPUs and software without maintaining expensive internal infrastructure.

- Expert Support: Expert teams ensure optimized workflows and superior render quality.

- Scalability: Flexible solutions for projects of all sizes and complexities.

- Rapid Turnaround: High computing power allows for faster project completion.

- Cost Savings: Reduced costs associated with maintaining internal resources.

Although the market hasn’t seen many significant new players in recent years, established render farms continue to dominate, offering reliable services.

Best Render Farm for 2026

As the industry evolves, these best render farms for 2026 are expected to remain at the forefront of innovation and service quality.

Fox Renderfarm

Known for secure and confidential rendering, Fox Renderfarm supports various software and plugins. It offers flexible pricing, with better rates for users with higher accumulated recharges.

- CPU: 20/24/26/28 physical cores CPU

- GPU: 1080Ti, RTX 2080Ti, RTX 3060/3090/RTX 4060/RTX 4090/RTX 5090

- RAM: 64/128/256 GB

- Price: the cost for CPU is $0.051/core/hour, while that of GPU is $7.8/node/hour

- Supported software: 3ds Max, Maya, Cinema 4D, Blender, Unreal Engine, Houdini, Arnold, V-Ray, Redshift, Corona, Octane, RenderMan, and plugins.

- Discounts and promotions: Free trial, user-level discounts, education discounts, seasonal sales, and referral program.

GarageFarm

GarageFarm is a seamless Software-as-a-Service (SaaS) render farm that integrates directly with 3D software. Its 24/7 support and automated workflow make it a favorite among artists and studios.

- CPU: Intel Xeon v4 22/44/88 physical cores, AMD Epyc 3rdgen 32 physical cores

- GPU: 1/2 x Nvidia RTX A5000, 4/8 x Nvidia P100, 1x Nvidia L40s

- RAM: 60/70/86/120/140/240 GB

- Price: From $0.024 to $0.072 per GHz hour for CPU rendering; from $0.004 to $0.012 per OB hour for GPU rendering.

- Supported software: 3ds Max, Maya, Cinema 4D, SketchUp, Blender, V-Ray, Corona, Arnold, Redshift, Cycles 4D, Luxcore Render ProRender, Vue, Lightwave, Modo, Rhinoceros3D, Terragen, and plugins.

- Discount and promotion: Free trial, volume discount, and 33% discount for Blender rendering.

iRender Farm

Known for GPU-accelerated cloud rendering, iRender offers high-performance machines and full control of remote servers. Its Infrastructure-as-a-Service (IaaS) model ensures compatibility with virtually any software or version.

- CPU: AMD Ryzen™ Threadripper™ PRO 3955WX, AMD Ryzen™ Threadripper™ PRO 5975WX

- GPU: 1/2/4/6/8 x Nvidia RTX 4090

- RAM: 256 GB

- Storage (NVMe SSD): 2TB

- Price: $8.2 – $52 per node per hour

- Supported software: Cinema 4D, 3ds Max, Maya, Houdini, Redshift, Octane, Blender, V-Ray, Unreal Engine, Arnold, Iray, Omniverse, Keyshot, Twinmotion, Lumion, Enscape, D5 Render, and more.

- Discount and promotion: Bonus for new users, volume discount, education discount, seasonal sale, and referral program.

Ranch Computing

Ranch Computing offers CPU and GPU cloud rendering for a wide range of applications, from architectural visualization to gaming. Its fully automated SaaS platform allows users to upload projects anytime, anywhere.

- CPU: AMD Epyc 7763, Dual Xeon E5-2697A v4, Dual Xeon E5-2690 v2

- GPU: RTX 3090/4090/5090

- RAM: 160/240/480 GB

- Price: From €0.011 to €0.015 per Ghz hour for CPU rendering; From €0.005 to €0.010 per OB hour for GPU rendering.

- Supported software: 3ds Max, Cinema 4D, Blender, Maya, Houdini, Maxwell, Indigo, Octane, Arnold, V-Ray, Redshift, Corona, FStorm, RenderMan, and plugins.

- Discount and promotion: Free trial, volume discount, education discount, and seasonal sale.

RebusFarm

Trusted for over 17 years, RebusFarm delivers high-speed rendering through its SaaS-based model, catering to projects of all levels with impressive reliability.

- CPU: AMD’s Threadripper 3970X

- GPU: NVIDIA RTX 4080 series

- RAM: 128 GB

- Price: From 1.39 cents per Ghz hour for CPU rendering; From 0.52 cents per OB hour for GPU rendering.

- Supported software: 3ds Max, Cinema 4D, Maya, Blender, V-Ray, Corona, Redshift, Octane, Mental Ray, Maxwell, Modo, Softimage, Lightwave, SketchUp, Rhino 3D, Arnold, and plugins.

- Discount and promotion: Free trial, volume discount, education discount, and seasonal sale.

Conclusion

In 2025, the 3D rendering market built a strong foundation for long-term growth. This growth is driven by innovation, cross-industry demand, and the rising importance of render farms. These trends are reshaping how high-quality visual content is produced at scale.

In 2026, leading providers like Fox Renderfarm, GarageFarm, iRender, Ranch Computing, and RebusFarm will lead. They offer scalable infrastructure, cloud workflows, and reliable performance for global 3D teams.

See more: Best GPU for 3D Rendering: Exploring 5 options for your project